News Letter – November 2017 – January 2018

Inside this edition

- Employees – What are we allowed?

- Alternative Dispute Resolution Series: How It can help You - Mediation in Employment Disputes

- Law Update: Trading on Easter Sunday

- Reforms in Trust Law – what it means for your trust

- How the Residential Care Subsidy can affect your Asset Planning – What you need to know?

- Snippets

Employees – What are we allowed?

When asking Kiwis what their entitlements are when it comes to annual leave, holidays and resignation, the responses are generally vague. Government statistics show that over 50% of working Kiwis have held their current employment position for less than 18 months, therefore, it is imperative for them to be familiar with employment law and employee rights.

Resigning

An Employment Agreement (“Agreement”) generally allows for employees to resign at any point in employment given they provide notice of resignation (“Notice”). Notice can be given in the manner specified in the Agreement or in writing at a minimum.

When resigning there are various options available; however, for the purposes of this article, two options are discussed in detail: Gardening leave, or an Agreement.

Firstly, employees may take what is often known as Garden Leave. Garden Leave allows for employees to be bound by their employment obligations and be paid as normal, whilst not undertaking work for the remainder of their Notice.

Granting Garden Leave requires mutual agreement by the employee and employer, although this agreement may be given under the Agreement. Gardening Leave is often used where employers wish to restrict the departing employeeʼs access to clients or confidential information.

Secondly, an Agreement can be reached between the employee and employer to terminate employment immediately rather than at the expiry of the Notice. If an employee does leave prior to the Notice period finishing, without the consent of the employer, the employer is entitled to seek damages or losses in the Employment Relations Authority or Employment Court. These damages may include the costs of hiring additional staff for the period of the Notice or the loss of work opportunities due to the lack of staff available.

In light of the potential repercussions outlined above, it is imperative that any agreement of this nature is documented in writing.

Final Pay

An employee is entitled to request their final pay on the last day of work rather than the following payday.

The final pay must include:

-

All hours worked since the last payday until the end of employment;

-

Any annual holidays, public and alternative holidays accrued; and

-

Any additional lump sum or other payments owing which may be included in the Agreement or negotiated as part of leaving.

If the final pay does not include the bulleted points above, employees are encouraged to, in the first instance, seek any entitlements in arrears from their employer. If a dispute arises, other options available include making a claim for a breach under the Agreement or the Employment Relations Act 2000. In the event of such a dispute, it is recommended to seek legal advice.

Holidays

Under the Holidays Act 2003, employees in New Zealand are entitled to a minimum of 4 weeks paid annual leave (“Leave”) per year with the opportunity to take at least 2 of the 4 weeks Leave continuously. Unless otherwise agreed, leave entitlements are subject to the employee working 12 months for the same employer.

Leave pay must be the greater of the ordinary weekly pay or the average weekly earnings over a 12-month period, prior to the Leave. The latter may be more relevant for employees who work on a commission basis or non-periodic schedules.

If an employee has worked for a 12-month period for the same employer, the employee may agree with their employer to either:

-

Take all Leave accrued that year; or

-

Take a portion of Leave accrued as soon as possible and carry over the remaining Leave into the next year; or

-

Be compensated financially for up to one week of Leave.

On resignation, if an employee has not reached 12 months of employment; they are still entitled to payment for annual holidays being calculated at 8% of their gross earnings during employment.

Employees are entitled to request unpaid leave in addition to their leave entitlements.

Summary

It is recommended that before resigning from a position, the Agreementʼs terms and conditions are read and understood. Understanding your entitlements and the right to request or demand an act or information as an employee is tremendously beneficial. This knowledge provides protection and ensures employees are informed, and treated fairly by their employer.

Alternative Dispute Resolution Series: How It can help You - Mediation in Employment Disputes

Alternative Dispute Resolution (“ADR”) methods are alternatives to going directly to court. Using ADR methods instead of pursuing the matter in court is usually more cost effective for all the parties involved, takes less time to resolve the dispute, and also relieves the court of cases they believe can be resolved between the parties without court assistance. This particular article will focus on mediation in the context of employment law and form a part of our ADR article series which will include articles on formal/informal negotiation and arbitration over the next two newsletters.

Mediation is essentially a voluntary process where an independent person (a “mediator”) assists the parties attending the mediation. This typically involves an employee and employer in an employment dispute, working through legal and emotional issues and developing solutions together to repair the employment relationship problems in a semi-formal and confidential environment.

Attending mediation is not like attending court as you are not under oath and are not cross-examined. Mediation requires the employee and employer (“the parties”) to attend the mediation, or it cannot proceed. Each party is entitled to bring representation and a support person to the mediation. At the beginning of the mediation, the mediator will outline the process of the mediation and ask the parties if they have any questions about the process. During the mediation, the mediator will ask each party questions to identify and refine the issues. The mediator will give each party the opportunity to speak; interruptions are not permitted. If the parties are not able to adhere to this rule, the mediator may put each party in separate rooms and talk to each party individually to attempt to reach a resolution.

Anything said during mediation and all documents prepared for the mediation, including the terms of the resolution, if one occurs, are confidential. Because of this, what happens in mediation may not be able to be used as evidence in the Employment Relations Authority (“ERA”) or Employment Court. Confidentiality encourages the parties to be honest and forthcoming with their information to increase the chances of reaching a resolution.

When preparing for mediation, the parties are encouraged to prepare written statements, accounts of events, and collate any evidence and documents such as texts or emails to support their position. To get the most out of mediation parties are encouraged to:

-

Listen to the other partiesʼ point of view, even if they do not agree;

-

Acknowledge anything they may have done differently or better;

-

Be honest and open;

-

Have an open mind for resolutions; and

-

Be willing to bend a little to reach an agreement.

Even if a resolution is not reached between the parties, they can request the mediator to recommend a non-binding solution under section 149A of the Act that the parties can consider. The mediator will make a written recommendation. The recommendation will include a date when the recommendation will become binding; the parties may consider accepting or rejecting the recommendation. Please note that if either party does not reject the recommendation before the specified date, it will become a full and final settlement and enforceable.

The parties also have the option of requesting a binding recommendation under section 150 of the Act.

Some advantages of resolving the dispute at mediation are:

-

The cost is significantly less than hearing the dispute in court; and

-

Mediation lets the parties have a degree of control over the agreement reached.

The disadvantages of mediation are that it may not result in a resolution, in which case the process will add to the legal costs.

Where the mediator feels that mediation is unlikely to produce a resolution, the mediator will usually conclude the mediation. The partiesʼ options at this point are to refer the matter to arbitration or the ERA or to stop pursuing the matter altogether.

If you are an employer or an employee and facing this situation, it is best to seek legal advice.

Watch this space for our article on Arbitration in our next newsletter.

Law Update: Trading on Easter Sunday

Easter Sunday is not a public holiday, yet most businesses used to have to be closed on this particular day. However, changes to the Shop Trading Hours Act 1990 (the “Act”) that came into effect in August 2016 mean that all territorial authorities (city and district councils) now have the power to have a local Easter Sunday shop trading policy to permit shops to open on Easter Sunday in areas comprising the whole or part(s) of an authorityʼs district. At least 25 of the 67 local councils in the country have already passed bylaws allowing shops to open on Easter Sunday.

The changes to the Act stipulate that employers who plan to open on Easter Sunday must notify their employees of their right to refuse to work on Easter Sunday (“Notice”). The Notice itself may be in the form of a letter or memo delivered in person, or by email or via group email or in a way that is specified in the employment agreement (“Agreement”). Notice must be provided to the employee between four and eight weeks in advance of the relevant Easter Sunday. The employer is required to repeat this practise each year they would like an employee to work on Easter Sunday.

In the event an employee has commenced employment within four weeks of the relevant Easter Sunday, the employer is required to give this employee Notice as close to the start date of their employment as possible.

Please note that the process described above cannot simply be written into an Agreement. New legislation makes any provision in an Agreement which requires an employee to work or be available to accept work on Easter Sunday, unenforceable.

If a business is prohibited from operating on Easter Sunday (due to the relevant territorial authority not having a local policy or the business falling outside the existing exemption categories) but they would still like their employees to work on Easter Sunday, for instance, to stack shelves or do a stock take, they are still required to follow the practice of written notification as would have been done if the business had been open to the public for the day.

Employees who have received Notice and intend to exercise their right to refuse to work are required to inform their employer by a notice in writing within 14 days of the date they received the Notice. This can be by letter or email or in a way specified in their Agreement.

Where an employee has started work within 14 days prior to the relevant Easter Sunday and has received Notice and wants to refuse to work, that employee must give the employer their notice as soon as possible after receiving the Notice from the employer.

If the employee does not follow these notice requirements, and their Agreement has a clause stating that they can be required to work on Easter Sunday, the employer can require them to work.

If the employer does not follow the notice requirements and requires an employee to work on Easter Sunday, their actions are likely to be viewed as compulsion and would expose them to a personal grievance claim by the employee.

Scenarios where the employer would be likely to be deemed to have compelled an employee to work include instances where:

-

They have added working on an Easter Sunday as a condition of the continuing employment of an employee;

-

They have unfairly influenced the shop employee to try to convince them to work on an Easter Sunday; or

-

They have required an employee to work on Easter Sunday without giving them the correct Notice as prescribed by the Act.

Employers are barred from treating their employees adversely for exercising their right to refuse to work. Examples of treating an employee adversely may be not offering an employee the same working conditions compared with another employee in similar circumstances, or dismissing or retiring an employee.

If an employee thinks that they have been treated adversely by the employer because they refused to work on Easter Sunday, they can raise a personal grievance claim against them.

If you are an employer and need guidance on the Easter Trading laws, we recommend you seek advice from a lawyer.

Reforms in Trust Law – what it means for your trust

Family trusts are a practical structure for holding assets, particularly in New Zealand where there are approximately 300,000 to 500,000 trusts operating today. Currently, the Trustee Act 1956 and the Perpetuities Act 1964 contain provisions which need to be read in conjunction with case law regarding their operation, and do not keep up with present-day trust practices. Therefore, the updates regarding trust law under the current Trusts Bill (“Bill”) are long overdue, being the first significant reform for at least 60 years. The Bill will replace these Acts, clarify core trust concepts and create more practical trust legislation.

Overview of proposed changes

The underlying principles of the Bill are largely derived from the Law Commissionʼs views in 2013 which recommended that the existing law should be more comprehensible rather than introducing substantial changes. The Bill aims to facilitate the progression of trust law through the courts while also providing:

-

A description of the rights and obligations under an express trust e.g. family trusts;

-

Clarity regarding compulsory and default trustee duties (derived from existing legal principles) and the exercise of flexible trustee powers (including trustee agents and delegates) when managing trust property;

-

Requirements for managing trust information and disclosing information to beneficiaries (where applicable) so they are aware of their position;

-

Transparency around establishing, varying and terminating trusts to achieve cost-effective administration of trusts;

-

Alternative dispute resolution mechanisms to pragmatically resolve internal and external trust-related disputes;

-

A description of some of the courtʼs powers and avenues available for court assistance; and

-

The circumstances in which trustees must or may be removed or appointed outside of court.

Trusts subject to the Bill

The Bill will apply to all (including existing) express trusts; however, it can also apply to trusts that are created under an enactment that is consistent with the Bill or as the courts direct.

Trust duration and distribution

Currently, the vesting date for trust property of 80 years is provided under the complex Perpetuities Act 1964 and case law. The Bill proposes to remove the existing rule against perpetuities and provides that an express trust can exist for a maximum of 125 years or a shorter duration as specified in the trust deed. This is aimed to provide certainty in trust dealing, avoid indefinite trusts and allow settlors to distribute property as they choose.

Upon expiry of a trust, all property must be distributed in accordance with the trust deed or, if the deed is silent about how property is to be distributed, in a way that is consistent with the objectives of the trust. Where there are surviving beneficiaries and it is not possible to determine how to distribute property in accordance with the trust deed, the property must be distributed to the beneficiaries in equal shares.

Trusteesʼ duties and powers

The Bill provides for five mandatory trustee duties that cannot be excluded from a trust deed. These include the duty to act in accordance with the terms of the trust and to act in good faith. The 10 remaining default duties, including the duty to act impartially, can be amended or excluded by the terms of the trust deed.

There is a presumption that trustees must provide basic information to the beneficiaries such as notifying beneficiaries of their position and the right for beneficiaries to request trust information and the contact details of the trustees. Trustees must consider certain factors, such as the age and circumstances of the beneficiary or the effect on those involved with giving the requested information, before deciding whether this presumption applies. If the trustees reasonably consider that information should not be given after reviewing the mandatory factors; the trustees may refuse the information request. The Bill sets out the procedure for trustees when deciding to withhold information.

Summary

The Bill is currently in its first reading. Once enacted, there will be an 18-month transition period to allow anyone involved in trusts to consider the application of the Bill to their trust. This long-awaited Bill aims to be a flexible tool to accommodate the wide use and effective management of trusts for the benefit of our societyʼs future asset planning.

How the Residential Care Subsidy can affect your Asset Planning – What you need to know?

The Residential Care Subsidy (“Subsidy”) is becoming increasingly topical as New Zealandʼs 65+ population is projected to increase from 15% in 2016 to over 25% by 2068. The growth in this population will increase the number of Subsidy applications for financial assistance for long-term residential care in a rest home or hospital (“Care”). Despite the predicted growth in applications, many New Zealanders are not aware that their current asset planning has the potential to affect the outcome of a Subsidy application significantly. In light of this, advice surrounding asset planning in consideration of a Subsidy application is essential.

The Ministry of Social Development (“MSD”) determines Subsidy applications. When considering an application, they will conduct a financial means assessment to determine whether the applicant qualifies under the prescribed eligibility thresholds. This includes both an asset and an income assessment.

Before the applicant undertakes the income assessment, MSD will first assess whether they qualify under the asset assessment (“Assessment”). The asset thresholds for the Subsidy are as follows:

-

A single applicant or applicants that have a partner in Care: The total value of their assets must not exceed $224,654.00 including the value of the family home and vehicle;

-

Applicants who have a partner that is not in Care can elect to be assessed under either of the following thresholds:

-

Their assets must not exceed $123,025.00 (not including the value of the family home and vehicle); or

-

The total value of all their assets (family home and vehicle included) must not exceed $224,654.00.

The Gifting Provisions

MSD implemented gifting thresholds to prevent the giving away of assets with the purpose of attempting to qualify under the asset thresholds for the Subsidy.

Gifting thresholds apply to gifting commonly, i.e. birthday gifts, and gifting undertaken to a Family Trust (“Trust”). Gifting to a Trust is when an individual (“Settlor(s)”) who owns assets such as houses, cash and shares, sells these assets into a Trust. In return, the Trust owes a debt back to the Settlor(s). The debts are then “forgiven” by the Settlor(s) through a process called gifting.

The MSD gifting thresholds are:

-

Five years before applying for the Subsidy each person can gift up to $6,000.00 each annually. In this case, those in a qualifying relationship under the Property (Relationship) Act 1976 (“relationship”) may gift $6,000.00 each.

-

Beyond five years before the Subsidy application, a couple or individual can gift up to $27,000.00 annually. In this case, those in a relationship may gift up to $12,500.00 each.

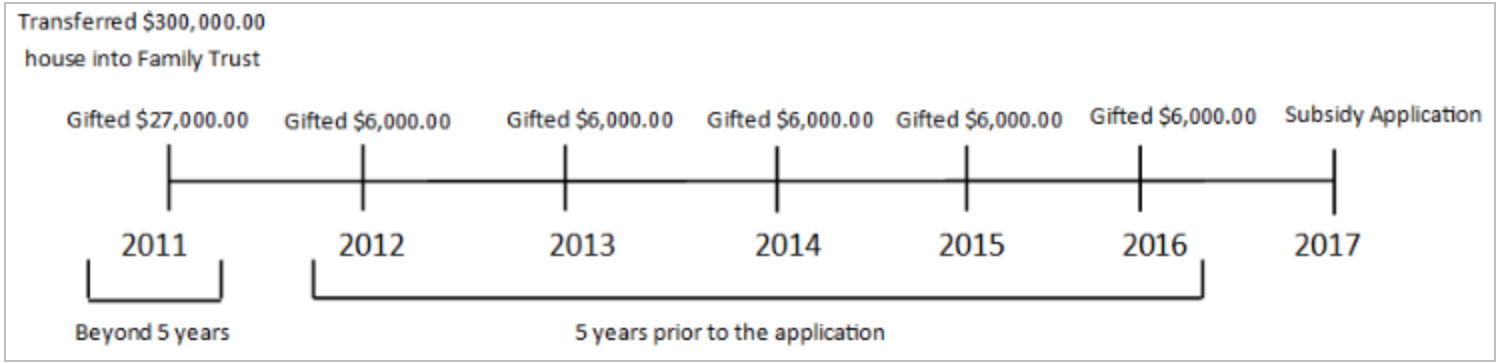

Gifting that falls under the prescribed gifting thresholds will not be considered in the Assessment. However, if an applicant has sold an asset into a Trust that exceeds the gifting threshold, MSD will consider the value of the asset that exceeds the gifting thresholds as a personal asset. For example, an applicant sells their house valued at $300,000.00 to their Trust in 2011 and gifts annually until 2016; they apply for the Subsidy in 2017. MSD will subtract the value of the prescribed gifting being $27,000.00 in 2011 and $6,000 annually until 2016. The remaining $243,000.00 will be considered a personal asset under the Assessment. The applicant would not qualify for the Subsidy in this instance.

Please see diagram below which offers a visual aid to the implementation of the MSD gifting thresholds:

If the same applicant had a partner who was not in Care, it may have been more beneficial for the applicant to hold the property as a personal asset. If the house was a personal asset, in this case, they could be considered under the eligibility threshold which excludes the value of the family home and vehicle if they chose. The applicant would qualify for the Subsidy in this instance.

Please note MSD will only consider gifting to a Trust that has been completed and will not take into account any entitled gifting that has not been completed.

Recommendations:

-

Plan in advance. If a Subsidy application is likely, and you own a trust; implement a consistent gifting regime so that you can take advantage of MSDʼs prescribed gifting thresholds.

-

If you already have a trust or are considering forming a trust and may apply for the Subsidy, consider seeking legal advice on your position, including whether you could consider selling your home out of your Trust to meet the Assessment.

Please note that this article only covers aspects of a Subsidy application. For more comprehensive advice, please seek legal counsel.

Snippets

Trading hours over Christmas

As Christmas day is less than two months away, we think that now is a good time to give you a reminder about where you can purchase your festive booze on the day.

Under the Sale and Supply of Alcohol Act 2012, only premises holding an on-licence can sell you liquor as they would on any ordinary day, if you are residing on the premises (as in a hotel situation) and dining in. In terms of the dining times, you are allowed to be served alcohol up to an hour before and an hour after your meal. Restaurants that are open on the day will also be able to serve you liquor as an accompaniment to your meal. Casual drinking is not permitted at all. As a third option, you may also be able to access liquor at a licensed club if you are a member, invited guest or visitor of the club concerned. Lastly, we remind you that if you are going to be indulging in a drink or two and getting merry, then please donʼt drive.

Wacky Christmas Laws and Practises

In the Spirit of Christmas, here are some strange practises and wacky Christmas laws from around the world:

-

In England, it was illegal to eat mince pies on Christmas Day from 1653 to 1658;

-

In America, Christmas was banned from 1659 to 1681;

-

In Caracas, Venezuela, on Christmas Day, the roads are closed, so people roller skate around the city; and

-

On Christmas Eve at noon, the Declaration of Christmas Peace is read in a formal ceremony in South Finland which states that any behaviour which jeopardises the joy of the holiday will be met with the full force of Finnish law.

New Zealandʼs laws are not as wacky; however, the following is worth a mention. Christmas Day was not considered a public holiday until the Arbitration Act 1894, and the Holidays Act 1910 implemented the legal entitlement to take Christmas Day off.

Merry Christmas everyone!